Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Introduction

YNAB review 2025 — if you’re considering this budgeting app in the current year, you’re not alone. Let’s kick things off with a raw confession: I used to be terrible with money. Picture this—me, sweating bullets as I opened my banking app, avoiding credit card statements like they were spoilers for my favorite show, and whispering, “Next month, I’ll figure it out.” Sound familiar? Then I stumbled into You Need A Budget (YNAB), the budgeting app that’s been around since 2004 but still dominates 2025’s personal finance chatter as one of the best budgeting apps out there. But here’s the million-dollar question: Is yneb still worth it for beginners, or has it been outshined by sleek new apps?

After three years of religiously using YNAB (and occasionally yelling at my phone when I blew $50 on artisanal toast), I am giving my YNAB review 2025. In this YNAB review 2025, I’m breaking down its highs, lows, and whether it’s the right fit for you. Spoiler: It’s not perfect, but it might just turn your financial chaos into clarity.

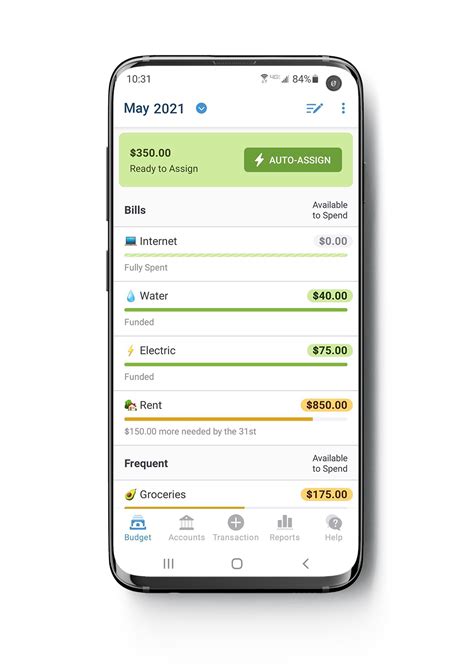

YNAB isn’t just another app that passively tracks your spending. It’s a mindset shift disguised as software. Built on the “zero-based budgeting” method, YNAB forces you to give every dollar a job—whether it’s rent, Netflix, or your emergency fund. No more vague “I’ll save what’s left” promises.

Here’s How It Works in 2025:

Why Read This YNAB Review 2025? This YNAB review 2025 covers everything you need to know about YNAB in 2025, ensuring you make an informed decision for your financial future.

Key 2025 Features:

Pricing: Still $99/year or $14.99/month. Steep? Maybe. But YNAB claims users save $600 in their first two months.

Most apps (cough Mint) let you track spending after the fact. YNAB makes you plan every dollar upfront. When I started, I realized I’d been blowing $300/month on “miscellaneous” (ie: impulse buys). Painful? Yes. Life-changing? Absolutely.

As a gig worker, my income swings like a pendulum. YNAB’s “Age Your Money” rule taught me to budget last month’s income, so a late client payment doesn’t trigger a ramen-only week.

YNAB’s Facebook group feels like a therapy session for budget nerds. Plus, their customer support replies faster than my best friend (under 2 hours, tested twice).

After 6 months, I was budgeting with money I’d earned two months prior. That buffer saved me when my dog decided to swallow a Lego.

YNAB’s mantra: “Want that $80 concert ticket? Move money from ‘eating out’ to ‘fun.’” No judgment—just intentional choices.

YNAB’s jargon—think “wish farms” and “credit card float”—left me Googling at 2 a.m. Beginners might rage-quit before the “aha!” moment (which took me 3 weeks).

At $99/year, YNAB costs more than Hulu, Disney+, and Spotify combined. Competitors like Simplifi ($48/year) or PocketGuard (free) undercut it.

Sure, YNAB syncs with banks, but they want you typing in every $4 latte. Why? To “build mindfulness.” But after a 10-hour workday, mindfulness feels like a chore.

YNAB focuses solely on budgeting. If you want to track stocks or retirement accounts, pair it with Empower or Personal Capital.

Blow your “groceries” budget? YNAB slaps a red “overspent” label on your face. Motivating for some, soul-crushing for others.

Yes if…

No if…

My Take: YNAB helped me save $10k in 18 months and finally sleep through the night. But it’s like a gym membership—you only get results if you show up.

Try It Free: YNAB’s 34-day trial requires no credit card. Worst case? You’ll finally know where your money’s vanishing.

Wrap-Up & Interaction

So, what’s your vibe? Are you team YNAB, or did you ditch it after week one? Drop your horror (or success!) stories in the comments! And if this review saved you from a budgeting meltdown, share it with that friend who’s always “borrowing” $20 until payday.

Subscribe to our newsletter!