Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Disclaimer: This guide is for educational purposes only and is not financial advice. Crypto staking involves inherent risks, including smart contract failure, slashing, and market volatility. Always do your own research (DYOR) and seek advice from a licensed financial professional. For income strategies, see our guide on AI Side Hustles that Pay.

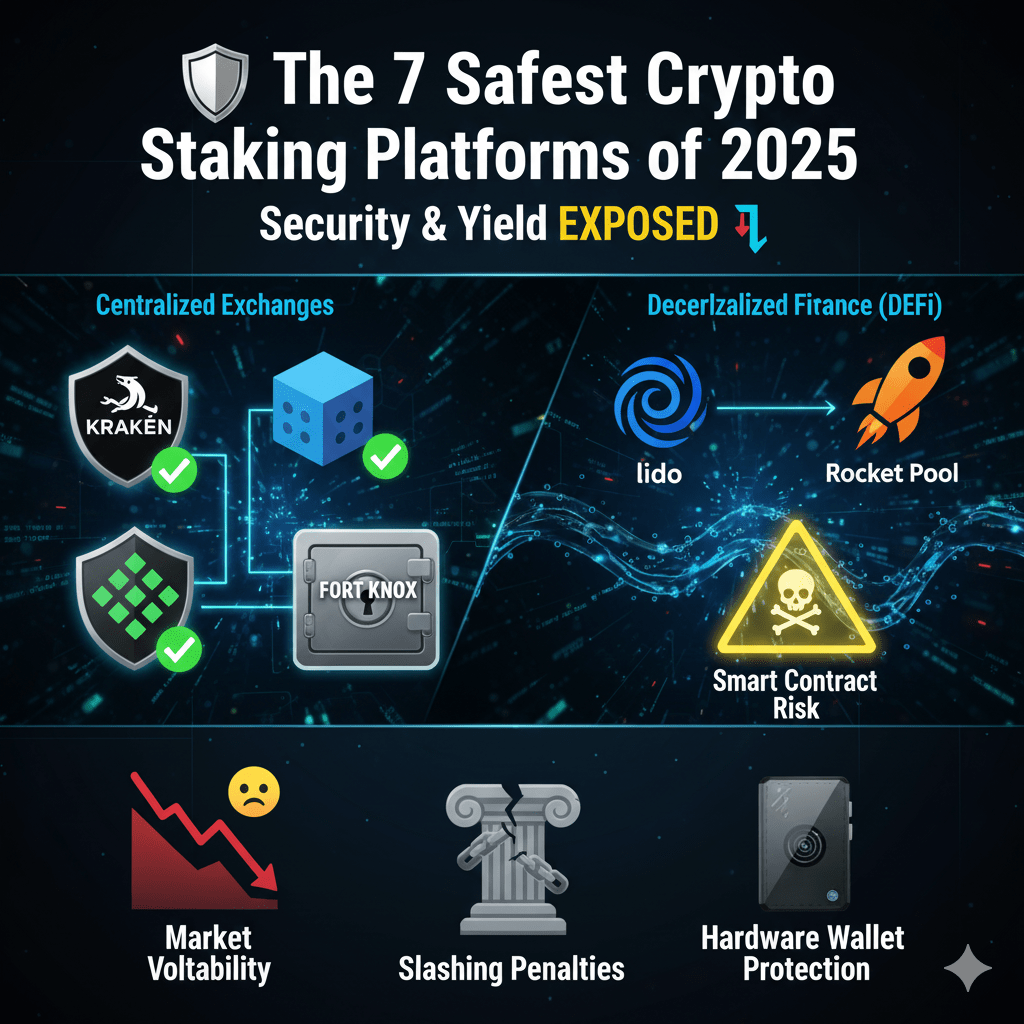

In the maturing crypto landscape of 2025, the most important metric for passive income is no longer the highest Annual Percentage Yield (APY), but security and risk management. After major hacks and regulatory shifts, informed investors prioritize E-E-A-T (Expertise, Experience, Authority, and Trust) when choosing a staking platform. This commitment is why we investigate the safest crypto staking platforms available today.

The regulatory environment, particularly the influence of bodies like the US SEC and the implementation of Europe’s MiCA framework, has significantly increased scrutiny on staking providers. Platforms that cannot demonstrate strict security protocols, transparent reserve management, and robust consumer protections are now viewed as ticking time bombs. Therefore, our deep dive into the safest crypto staking platforms must look beyond merely the reward rate and instead verify the underlying infrastructure. A lower, verifiable yield on an audited platform is always superior to an unsustainable, high yield on a platform lacking transparent E-E-A-T.

Our analysis focuses on three critical security pillars: Custody Model, Slashing Protection, and Audit Frequency. This guide will break down the risks and compare the safest crypto staking platforms available for earning passive income on your Proof-of-Stake (PoS) assets.

| Term | Definition | Risk Level |

|---|---|---|

| Custodial Staking | The exchange holds and stakes your private keys on your behalf. Easiest for beginners. | High Custody Risk. If the exchange is hacked or fails (e.g., FTX), your assets are vulnerable. |

| Non-Custodial Staking | You retain ownership of your private keys (via a wallet like Ledger or MetaMask) while delegating to a validator. | Low Custody Risk. Higher Smart Contract Risk. |

| Slashing | A penalty imposed by the blockchain protocol for validator misconduct (e.g., double-signing transactions or prolonged downtime), resulting in a loss of your staked tokens. | Medium. Platforms must offer protection against this. |

| Liquid Staking Tokens (LSTs) | Tokens (e.g., stETH, rETH) that represent your staked position. You can trade or use the LST while still earning staking rewards. | Medium/High. Introduces risk of the LST de-pegging from the underlying asset. |

| De-pegging Risk | The LST loses its 1:1 parity with the underlying staked asset (e.g., stETH trades below ETH value) due to liquidity pool issues or market panic. | High. Can result in sudden, significant losses of principal. |

| Inflation Risk | The native token’s supply increases faster than the staking reward rate, diluting the value of the staked tokens and offsetting the yield. | Medium. Requires investors to research the network’s tokenomics before staking. |

Centralized Exchanges offer the easiest and most user-friendly entry into staking. When searching for the safest crypto staking platforms, CEXs like Kraken offer a great balance of security and ease. They handle all the technical complexity, validator management, and infrastructure for you. The trade-off is giving up control of your private keys (custody risk).

Kraken is consistently rated as one of the most security-conscious exchanges globally. They are famous for their Proof-of-Reserves (PoR) audits.

| Metric | Kraken Staking Analysis (2025) | E-E-A-T Score |

|---|---|---|

| Custody Model | Custodial (Exchange holds private keys) | 3/5 |

| Security Score | 95% of assets in Cold Storage. Regular PoR audits. ISO/IEC 27001 certification. | 5/5 |

| Yield (Example) | Up to 21% APY (Cosmos, Polkadot) | Competitive |

| Lock-Up / Flexibility | Mostly Flexible staking available for major assets (ETH, SOL, ADA). | Excellent. High liquidity. |

Expert Commentary: Kraken excels for security-first investors who want minimal lock-up periods and prefer the regulatory protection offered by a veteran, well-audited exchange. Their commitment to cold storage significantly mitigates the primary custody risk, making it one of the safest crypto staking platforms.

Kraken pioneered the Merkle Tree Proof-of-Reserves (PoR) audit system. This means they regularly publish cryptographic proof that the funds they hold in reserve match their customer liabilities. This transparency allows users to independently verify the safety of their assets without compromising privacy—a massive E-E-A-T signal. For staking specifically, Kraken ensures its own validators are reliable, absorbing the risk of slashing on your behalf. This makes it an ideal platform for those unwilling to take on the technical responsibility of running a node.

Coinbase remains the most accessible and regulated platform for US-based investors, prioritizing compliance and simplicity.

| Metric | Coinbase Staking Analysis (2025) | E-E-A-T Score |

|---|---|---|

| Custody Model | Custodial | 3/5 |

| Security Score | Regulatory Compliance. SOC 2 Type 1 Audit. Strong institutional-grade custody solutions. | 4/5 |

| Yield (Example) | Lower Yields, up to 13% APY (Tezos, Ethereum) | Competitive but often lower due to fees. |

| Lock-Up / Flexibility | Flexible staking available, but ETH staking involves lock-up for withdrawals. | Good for liquidity management. |

Expert Commentary: Coinbase is ideal for beginners and regulated investors. The platform is highly secure but takes a higher commission (up to 25% of rewards) to cover their operational and compliance costs, resulting in lower net yield. We consider it one of the safest crypto staking platforms for new entrants.

Coinbase’s strength lies in its compliance footprint, which includes carrying a comprehensive insurance policy against hot wallet breaches (though this generally does not cover individual customer losses). Their higher fee structure is the price paid for this simplicity and regulatory oversight. When staking Ethereum, be aware that while the staking process is easy, the underlying Ethereum protocol mandates a lock-up period for withdrawals, which Coinbase cannot bypass. Always clarify the liquidity constraints for the asset you choose, as high liquidity risk can be detrimental in volatile markets.

Binance offers the greatest diversity of staking assets and flexibility, catering to users who prioritize high volume and optionality.

| Metric | Binance Staking Analysis (2025) | E-E-A-T Score |

|---|---|---|

| Custody Model | Custodial | 3/5 |

| Security Score | Robust security framework; strong cold/hot wallet mix. | 4/5 |

| Yield (Example) | Wide range, often 5% – 15% APY depending on term (locked or flexible). | Highly diverse offerings. |

| Lock-Up / Flexibility | Offers both Flexible and Locked Terms (up to 120 days). | Excellent variety for different strategies. |

Expert Commentary: Binance is best for experienced crypto users who want to stake a wide variety of Altcoins and leverage structured products. Users should always opt for locked terms for higher yields if they can tolerate the liquidity risk.

A unique feature of Binance is its SAFU (Secure Asset Fund for Users), an emergency insurance fund established to protect users in the event of a security breach. While the fund is massive and adds a layer of confidence, it is an internal fund managed by Binance, not a government-backed insurance scheme. When using Binance Earn, carefully distinguish between “Flexible” and “Locked” staking products. Flexible staking offers instant liquidity but lower APY, while Locked staking offers a higher APY but comes with a fixed, non-negotiable lock-up period (which directly increases your liquidity risk).

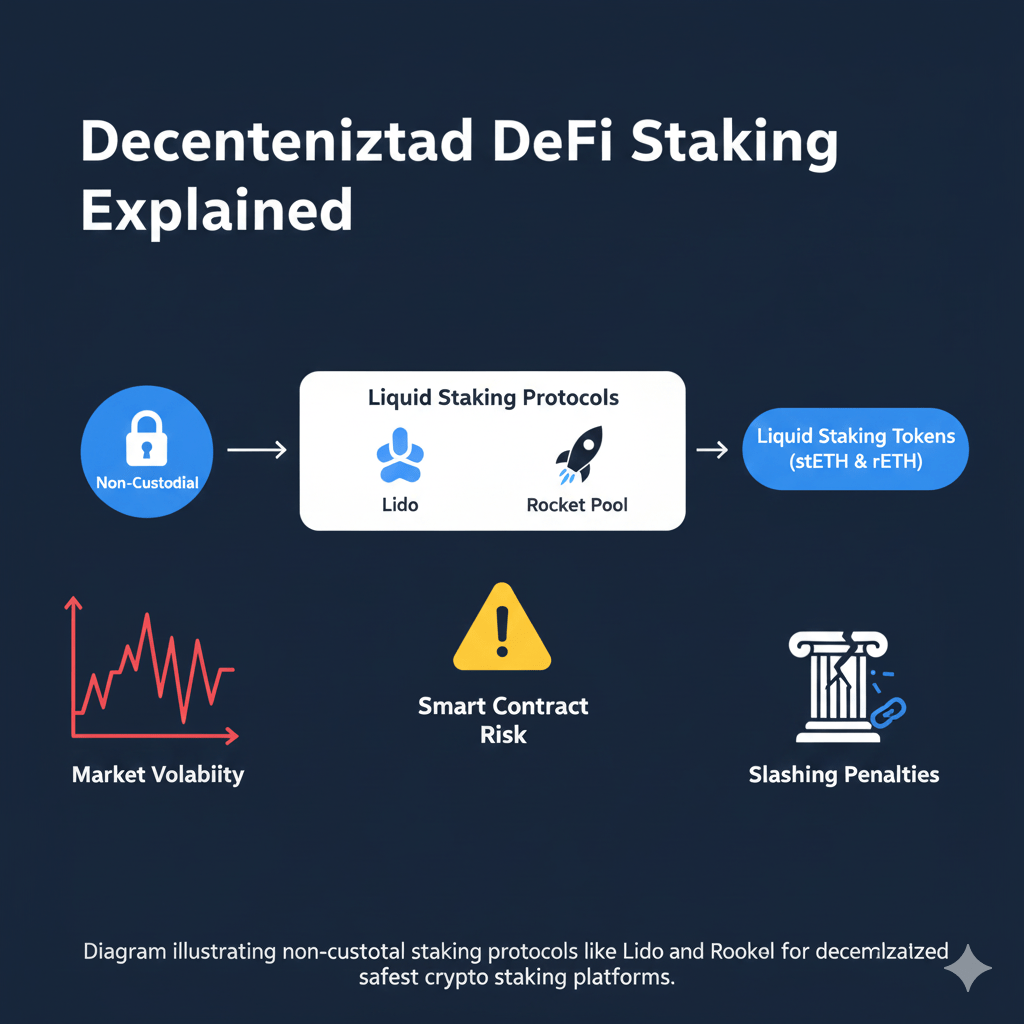

DeFi staking platforms (Liquid Staking Protocols) are considered safer from a custody perspective because you retain control of your private keys. However, they introduce a new, technical risk: Smart Contract Vulnerability. This requires a high degree of user expertise (E-E-A-T). When evaluating the safest crypto staking platforms, DeFi requires more due diligence.

Lido is the largest liquid staking protocol, primarily for Ethereum, allowing users to stake ETH and receive stETH tokens in return.

| Metric | Lido Staking Analysis (2025) | E-E-A-T Score |

|---|---|---|

| Custody Model | Non-Custodial. You control the keys. | 5/5 (for Custody) |

| Security Score | Massive Audit History. Frequently audited by firms like CertiK. Large, decentralized validator set. | 4.5/5 (High) |

| Yield (Example) | ETH staking rewards (~3.5% APR) | Stable and Protocol-Driven. |

| Risk / Lock-Up | Liquid Staking Risk. Risk of stETH de-pegging from ETH (tracking error). | No traditional lock-up. |

Expert Commentary: Lido is the benchmark for liquid staking. While it mitigates custody risk, the key vulnerability is the Smart Contract Risk (bugs or exploits in the protocol code) and the De-Peg Risk. It is vital to confirm the latest smart contract audit status before deploying funds.

Lido operates by pooling user funds and delegating them to numerous professional validators. When you stake ETH, you receive stETH—a tokenized representation of your staked ETH plus earned rewards. This LST allows your capital to remain liquid, meaning you can sell stETH on a decentralized exchange (DEX) immediately if needed. The de-pegging risk arises if large institutions suddenly sell massive amounts of stETH, destabilizing its price relative to ETH. This demands a higher level of experience from the investor.

Rocket Pool offers a highly decentralized and permissionless alternative to Lido, focusing on minimizing trust and ensuring maximum decentralization.

| Metric | Rocket Pool Staking Analysis (2025) | E-E-A-T Score |

|---|---|---|

| Custody Model | Non-Custodial. You control the keys. | 5/5 (for Custody) |

| Security Score | Audited and Open-Source. Known for its rigorous community testing and peer-reviewed code. | 4/5 (High) |

| Yield (Example) | ETH staking rewards (~3% APR) | Slightly lower than Lido due to decentralization focus. |

| Risk / Lock-Up | Uses rETH (the LST). Focuses on permissionless node operators. | Minimal LST risk due to smaller scale and community focus. |

Expert Commentary: Rocket Pool is for users with a high level of Experience who prioritize decentralization above all else. Its smaller scale and focus on peer-reviewed security make it a favorite among blockchain veterans.

Rocket Pool’s security model is built around “mini-pools” and lower collateral requirements for node operators (validators). This encourages a much wider set of individual node runners, vastly increasing network decentralization—a key security feature against cartelization or single-point-of-failure attacks. The rETH liquid staking mechanism is generally considered highly robust due to the protocol’s transparent and highly conservative security parameters, often making it the choice for sophisticated DeFi users looking for safety through decentralization.

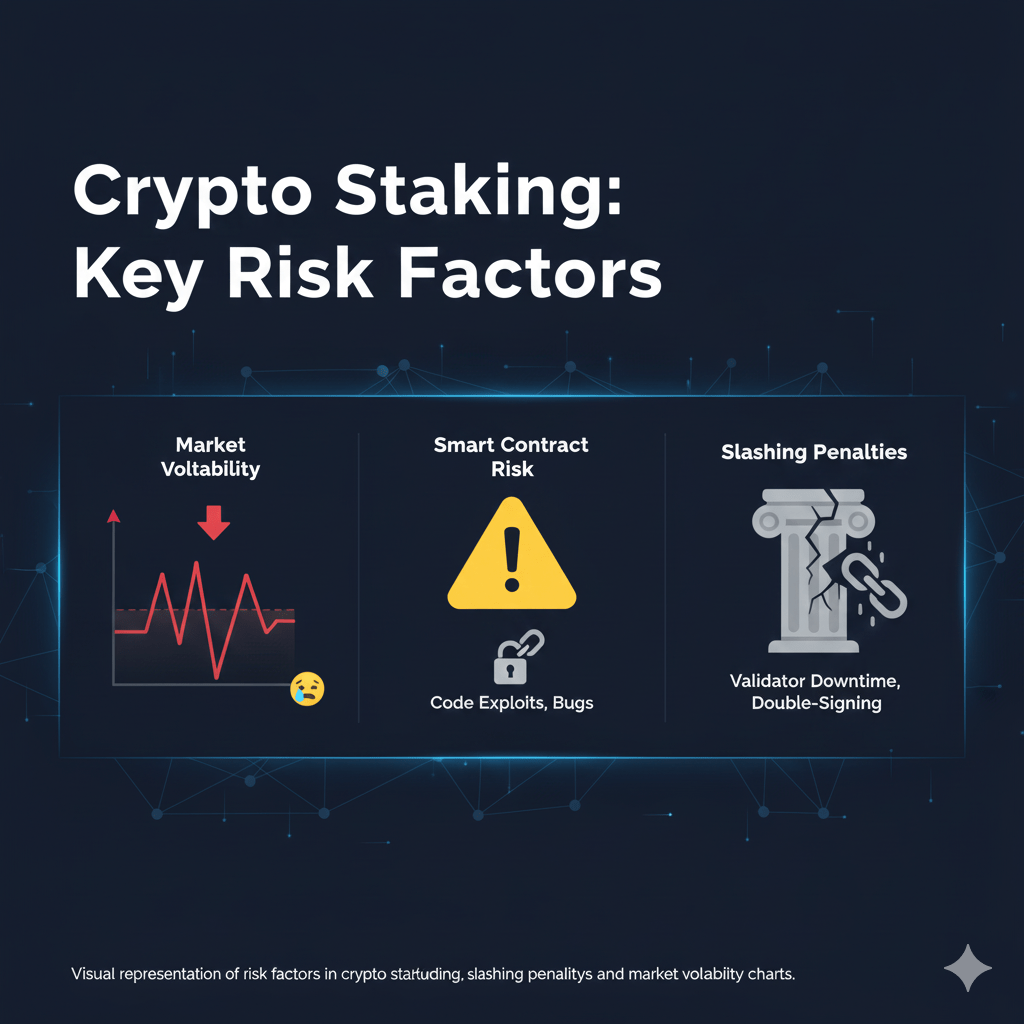

Before comparing the platforms, every investor must acknowledge the two primary risks that differentiate staking from traditional investment: technical penalties and market risk.

Slashing is the built-in economic deterrent designed to keep validators honest. It is essential to choose a platform that explicitly addresses this.

The single biggest risk in staking is not technical, it’s market-based: your staked asset can depreciate faster than the yield you earn.

| Platform | Custody Risk | Slashing Protection | Audit Frequency / Firm | LST Risk (Liquid Staking) | Overall Security Score (Out of 5) |

|---|---|---|---|---|---|

| Kraken | Medium (Custodial) | High (Covered by exchange) | Regular Proof-of-Reserves; ISO Certified | None | 4.8 |

| Coinbase | Medium (Custodial) | High (Covered by exchange) | SOC 2 Type 1 Audit; Regular Compliance | None | 4.5 |

| Binance | Medium (Custodial) | High (Covered by exchange) | Strong internal security team | Low (liquid ETH staking available) | 4.4 |

| Lido Finance | Low (Non-Custodial) | High (Decentralized validators manage risk) | Critical: Multiple Audits by CertiK, Trail of Bits | High (stETH De-peg risk) | 4.2 |

| Rocket Pool | Low (Non-Custodial) | High (Protocol manages risk) | Open Source; Peer-Reviewed Security | Low (rETH tracking error risk) | 4.3 |

Before staking any amount of cryptocurrency, you must demonstrate the Expertise and Responsibility required for this investment class. This checklist is non-negotiable for safe staking:

The safest choice depends entirely on your knowledge level:

Never chase the highest yield. In staking, the highest advertised number often comes with the highest, most often overlooked, security risk.